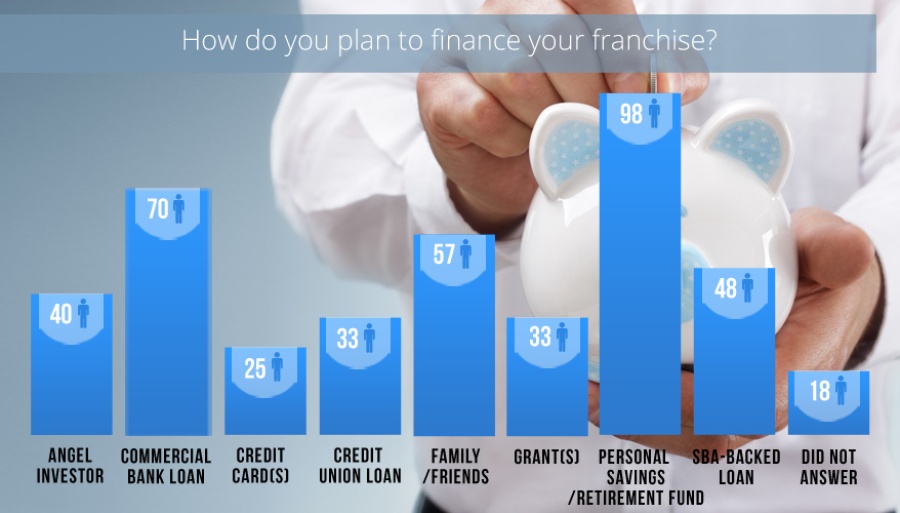

Findings from our Survey on Source of Financing

Of interest to virtually all prospective franchisees is how they are going to get the funding necessary to finance their franchise aspiration. Since the recession of 2008, however, there’s been a shift in where prospective franchisees are getting their investment money. Years ago most franchises were funded primarily by way of bank loans (credit) – and they are still popular. But nowadays personal savings lead prospective franchisees’ potential financing options.

In the immediate aftermath of the recession and the resultant recovery phase, traditional bank funding became so difficult to obtain that prospective franchisees fortunate to have some kind of nest egg forewent traditional lenders and turned towards their own resources to finance their franchise ventures. Many did this by using their retirement accounts in a setup known as ROBS, or Rollovers for Business Startups.

ROBS have been around for decades but when the market crash happened, people realized “maybe I’d like to invest in myself and control my destiny,” says Rocco Fiorentino, CEO of Benetrends. “In 2008, 2009, 2010, when access to credit was very difficult the rollovers were really very popular and, frankly, most franchisors were recommending that as a way to fund the businesses.”

But, while prospective franchisees have found the benefit in using their retirement funds for franchise funding in the years since the recession, it’s not a catchall. Many prospective franchisees are keen to diversify how they fund a franchise.

“We’re finding there’s a trend, especially in franchising, where there is more than one source of capital being utilized in a transaction,” David Nilssen, co-founder & CEO of Guidant Financial said in an interview with Franchise Today. “Years ago we saw that this person did all [retirement fund] rollover or this person just the SBA [loan], but now we’re seeing a combination of multiple strategies being used at one time.”

Since multiple means of finding the money to finance an initial franchise investment are typically used, it’s to the prospective franchisee’s advantage to be armed with knowledge of what to look for in lenders. Here are 4 tips from David on how to evaluate financing firms:

- Is the financing firm willing to invest quality time with you during the process? “At the end of the day, most of these lenders are still underwriting the individual borrower much more than the actual brand itself…it’s going to be based on their belief that this borrower has the ability to pay that [money] back.”

- Be wary of blanket statements and programs. “There’s no one-size-fits-all requirement, for lack of a better term.”

- Don’t wind up a guinea pig. “You want to work with someone who knows how to navigate those processes and do it efficiently and effectively. It’s not about getting the deal done fast, it’s about getting the deal done right.”

- “At the end of the day, trust your gut.”

How does the traditional credit market look going forward? “Back in 2008, we had lending practices that were very loose. Since that recovery a couple of things have happened that are to our benefit,” David says. “I still think that there is a slight [over correction] in terms of lenders’ desire for collateral and coverage, but I think you’re seeing more prudent lending practices and so the lenders are more focused on the viability of the candidate coupled with the type of business they’ll be operating. I think the outlook is strong.”