Sometimes also referred to as the personal care service industry, businesses under the umbrella of health and beauty cover a wide swath of products that help customers feel their best (health/wellness) and look their best (beauty). The larger divisions of the industry are as follows, per the North American Industry Classification System (NAICS):

Popular franchises within the industry include: Fantastic Sams, Sport Clips, The Joint Chiropractic, Urban Float, Great Clips, Massage Envy, Relax the Back, Seva Beauty, BodyBrite, Merle Norman, The Lash Lounge, Palm Beach Tan, NutriMost, and more. A number of franchises provide services in multiple segments. Some franchises can also crossover into the fitness franchise industry as well.

Outlook for the Major Health and Beauty Industry Segments

In the United States, of the segments without lodging that make up the industry, hair salons bring in the most yearly ($44 billion), and industry analysts expect the demand to continue rising over the next five years.

Beauty, cosmetics and fragrance stores hold an annual revenue total of $22 billion nationally. Growth in this sector has been buoyed by an increase in youth-targeted cosmetics, the expansion of male-specific products, and the change to more eco-friendly formulas.

Other segments of the industry may be larger and bring in money, but massage services ($16 billion annual revenue) has held the highest annual growth rate of the segments over the past five years at 7.1%. The second highest growth rate segment within the industry over the last five years is 6.7%, and it belongs to personal waxing and nail salons ($11 billion annual revenue).

The tanning salon industry ($2 billion annual revenue) is expected to continue its modest growth over the next five years by increasing its focus towards sunless tanning beds and merchandise.

Chiropractic care ($15 billion annual revenue) has emerged as a viable segment of the industry over recent years. Long viewed as an alternative medicine in the United States, chiropractic care is now becoming a more complementary part to the wellness routines of a growing part of the population.

The only segment of these that has somewhat struggled over the last five years is weight loss services ($2 billion annual revenue). However, over the next five years, the industry is expected to rebound slightly as “more health-conscious individuals will become aware of how weight loss plays an integral role in health and overall wellness, helping industry revenue. Further benefiting the industry segment, many physicians and health insurance providers [are expected to] promote weight loss as a form of preventive care in order to lower healthcare costs.”

Salon Suite Franchises Increasing Their Presence in the Health and Beauty Industry

“The emergence of salon suites and suite franchises solidifies the booth rental model’s place in the salon industry.” ~ Neil Ducoff, Salon and Spa Consultant

Every industry has employee turnover, but salons consistently rank among businesses with the highest employee turnover from year-to-year. There are several reasons, but many revolve around salon culture and desire for a work environment that better suits the worker personally. As a result, in their quest for more independence, health and beauty professionals have indirectly made property management a bigger piece of the industry pie.

For background, many salons are employee-based. Professionals within those salons rent their booth from their employer and pay a commission to the employer for the space they use. “The unofficial rule is for stylists to find a busy salon that provides advanced education, build a clientele… and then take that clientele to a better commission deal at another salon… or set up camp as a booth or suite renter,” says Neil Ducoff of Strategies, a salon and spa consultancy. “Why? Because it’s damn near impossible to rent a booth or suite and go it alone without the cash flow of a full book [the clientele list].”

For salon professionals that have decided to strike out on their own, suite rental franchises (such as Sola Salons, My Salon Suite or Salon Plaza) allow their clients to avoid the expensive cost of a studio build out and spread the cost of property rent among several tenets. The rentals also allow for the service providers to separate themselves from many of the constraints that come with working for traditional outlets.

Typically provided in the rental deals are access to fully-equipped studios alongside the tools needed to run a salon business and varying levels of support. According to Sola, salon suite rental services “offer salon professionals the freedom and benefits of salon ownership without the upfront costs and risks associated with opening a traditional salon.” The salon suite rental model “empowers hairdressers, estheticians, nail techs, massage therapists and other like-minded professionals to take control of their lives and their careers.”

But what does the rise of salon suite rentals mean for traditional salons? According to industry professionals, the traditional employee salon doesn’t need to worry about becoming obsolete.

“Is there a decline in the number of salons? Yes… a few percentage points… but nothing worthy of saying employee-based salons are done for,” Neil says.

How the Waning Taboo Surrounding Meditation is Helping Health and Wellness Franchises

Stress. A lot of people are dealing with it.

Citing numerous factors, the percentage of Americans who reported at least one symptom of stress over the past month was 80% in January 2017, up from 71% in August 2016. Mintel, a research firm, reports that 40% of people say stress is the main source of body pains.

Joe Beaudry was one of those people. In 2008, while seeking a way to gain an edge in his career, Joe discovered a community of “floaters” while internet searching. After some online forum back-and-forth, Joe decided to try floating – and became obsessed.

Not new to the American wellness landscape, floating made its first known appearance in the 1950s and had an initial boom period in the 1970s. It involves sealing yourself off in a pod or room designed for short term sensory deprivation. It’s typically done within a large tank of water saturated with magnesium (think Epsom salt) that makes you completely buoyant. Sometimes the tanks have controlled lights and sounds, but usually not. Benefits can include: sports injury recovery, stress reduction, anxiety reduction, increased circulation, pain relief, and a general relaxation boost.

Joe found that floating truly helped him reduce stress and improve his focus and memory, and felt it could help others. From his personal experiences he developed a floating business concept. Then he partnered with Steve Swerland, who already had wellness industry experience, and Urban Float was founded in 2011.

“Within 3 months of opening our first location we saw a high demand for floating and needed to make changes to meet the market,” Joe recalls. “The solution to increase our limited capacity in the early stages was to remain open 22 hours per day – and still, appointments were being booked up 3 weeks in advance. After 2 years of operation at nearly full capacity, it was time to add more pods to reduce the burden on the one location while improving the customer experience.”

The rise in the number of people floating dovetails with the increased interest in meditation and related practices. People are realizing emotional well-being is just as important as physical fitness to their health and wellness. While hard to pin down an exact number, it’s estimated that 30 million Americans have tried meditation.

“For a long time, people associated meditation with spirituality or religion or general weirdness,” explains Alex Tew, co-founder of meditation app Calm. “But now, in some places, it’s almost a badge of honor to meditate, which is a total 180 shift…It’s the same as physical exercise—it’s becoming a bigger trend because people are realizing that it’s good for them.”

Beyond floating, the move towards mindfulness is benefitting other health franchise concepts. For example, Serasana. Billing itself as an “experience offering,” the franchise is putting its spin on the more traditional spa concept by fusing a number of ancient wellness practices such as yoga, acupuncture, therapeutic massage, healing teas and other remedies.

Premium Experiences Becoming the Norm for Beauty Franchises

With so many options in the marketplace, beauty franchises have figured out the journey means just as much as the destination when carrying out services.

As noted in a Franchise Times article, positioning a brand as premium means going beyond décor and changing long-standing philosophies around traditional actions. In the article Ben Davis, owner of the men’s-centric upscale salon The Gents Place, explained why part of the proprietary training emphasizes getting “someone where they are emotionally to where we want them to be.”

For example, most hair stylists when initiating small talk ask the more common question: “What are you doing this weekend?” The Gents Place stylists are instead instructed to ask something to the effect of: “What’s something fun you’re looking forward to doing this weekend?” Another example is if a client says he’s a lawyer, the follow-up question is expected to be along the lines of: “What’s your finest moment as a lawyer?”

“It’s elevating the conversation,” Davis says of the practice. They want the client to leave “feeling amazing” in addition to looking good after his grooming experience.

Premium positioning isn’t just for luxury brands anymore. Results from an early 2017 Nielsen survey revealed that consumers will pay more for premium products if they deem the value is there, and the “personal care and beauty categories also have strong upgrade potential.”

“Many are looking for everyday items that perform better or fulfill their emotional needs or social aspirations at a price that doesn’t break the bank,” says Liana Lubel, senior VP of Nielsen’s Innovation Practice. “This is a ripe opportunity space for mainstream brands to provide premium products that are still affordable compared to higher-tier premium services and offerings.”

Elevating their brand in consumers’ minds will only increase in importance for business owners – franchise and non-franchise alike – as purchasing power shifts from generation to generation. While only 35% of Baby Boomers say they’re willing to pay more for premium product, 55% of the quickly-growing consumer force that are Millennials say they’re willing to pay more for premium.

Opening a Health and Beauty Franchise

Please note: the provisions and fees illustrated below are some of the most common and not a complete listing. Please review the Franchise Disclosure Document (FDD) of a franchise for all of the provisions and fees related to investing in that particular franchise.

Initial Investment

Franchisors offer estimates in their FDD based upon their experience establishing, and in some cases operating, units. However, prospective franchisees should keep in mind these estimates are just that – an estimate. Prospective franchisees should review the figures presented with a business advisor, taking into consideration their unique circumstances, before entering into a franchise agreement.

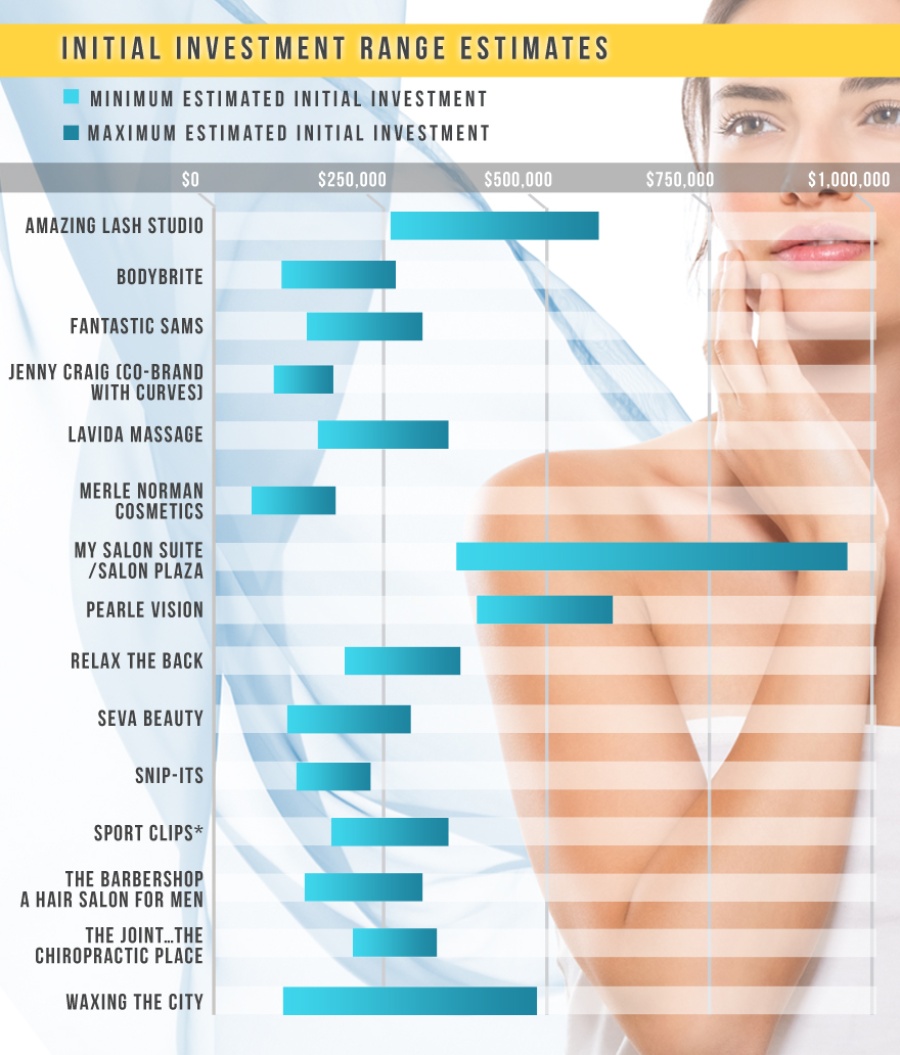

The following graphic provides the initial investment range associated with opening 15 health and beauty franchises. These ranges come from the FDDs of each respective franchise dated 2017.

Estimated Initial Investment Ranges for Selected Franchises

*The range for Sport Clips does not include a real estate or rent estimate.

Ongoing Fees

After the franchise business is up and running, there are a number of expenses required for the successful maintaining of the business. There are also a number of ongoing fees that are specific to being a part of the franchise system.

The most common ongoing fee for franchises is a royalty. Royalty fees are assessed for the continued use of the franchisor’s trademarks and patented processes. Examples of how royalties are collected are provided below for each example franchise. The amounts presented are as they appear in the franchise’s 2017 FDD.

| Franchise | Royalty |

6% of Gross Sales | |

6% of Gross Sales | |

$356.66 per week | |

The greater of $345 per month or 5% of the previous month's gross sales | |

5% of Weekly Gross Sales | |

N/A | |

5.5% of Gross Revenues | |

7% of Gross Revenues | |

| For new franchisees, the Continuing Royalty will vary between 2% and 5% during years 1 and 2, and will be 5% during year 3 and beyond. For existing franchisees, the Continuing Royalty for stores beyond the first will vary between 3% and 4% of Adjusted Gross Sales during the first year of operations at the additional location, and will be 4% during year 2 and beyond. |

6% of Gross Sales or $250 per week, whichever is greater | |

5% of Gross Sales for the first year, and 6% of Gross Sales for the balance of the term | |

6% of Net Sales | |

4.5% of Gross Sales (royalties decrease with ownership of certain number of locations) | |

7% of weekly Gross Revenues with a monthly minimum of $700 | |

Greater of (a) the Minimum Royalty Fee ($100/week), or (b) 6% of Gross Revenue each week |

Royalty Breakdowns for Selected Franchises

(More investment info for each franchise can be found at the links in the table)

Other regular ongoing fees include charges for marketing, software and technology, and more. In addition to regularly assessed fees, other fees charged by franchisors on an “as needed” basis include audit fees or costs for additional, non-mandatory, training.

Prior to investing, prospective franchisees should do their research and carefully review a franchisor’s FDD for more detailed information on all systems, procedures and costs. It’s important to note that while many ongoing costs are detailed in the FDD, there are some costs inherent to business ownership, like employee wages or utility costs, that aren’t.

For more information on numerous franchises, please see our health and beauty franchise profiles.